https://msgsndr-private.storage.googleapis.com/locationPhotos/51724b68-3de6-4f86-9dff-27f97fdc1692.png

Need help? (408) 688-5941

How the new FTC Safeguards Rule will impact California CPA Firms?

CPA Firms are in possession of critical consumer information, including access to customer names, addresses, tax information, credit card numbers, identifying business information, critical employee information, and other financial information which are prime targets for hackers.

With the FTC’s Safeguards Rule deadline going into effect on June 9th, CPA Firms will be required to have detailed procedures and specific criteria implemented in order to provide better protection and to curb data breaches and cyber attacks that could jeopardize sensitive customer data.

While most CPA Firms anticipate needing external support to meet the Rule’s security obligations, evaluating a myriad of vendors and tools to meet different sets of requirements can add to the existing burden.

Safeguards Rule compliance doesn’t have to be an overwhelming uphill battle.

Get the time, expertise, and resources you need to avoid heavy fines resulting

from non-compliance. At eSudo, we make things easy for you. Book A Call Today!

Cybersecurity Risk Consultant with over decades of IT experience & Co-Author of the #1 Best-Selling Managing Your Business Risk in the Cybersecurity Minefield book on Amazon.com.

Is my CPA Firm actually impacted by the new FTC regulations?

Yes. According to the Code of Federal Regulations,

§ 314.2(h), the FTC requirements apply to your CPA Firm and compliance is required by June 9th, 2022.

Can't you wait until later?

Unfortunately, no! The updated FTC regulations go into full effect June 9th, 2022. All CPA Firms, Tax Preparation and Financial Advisors will be subject to regulations, penalties, and fines as of this date.

Are the new FTC Safeguards Regulations complicated?

Ensuring that your CPA Firm is up to speed on the new regulations is a daunting process without help. In fact, professional I.T. support is now mandated by the Safeguards Rule.

What are the Fines and Requirements?

The PENALTIES or FINES for non-compliance can be as high as $43K per violation per day. Schedule a Call today to learn your options and avoid these fines?

Do wait 'Til It's Too Late or Tax Sessions Starts.

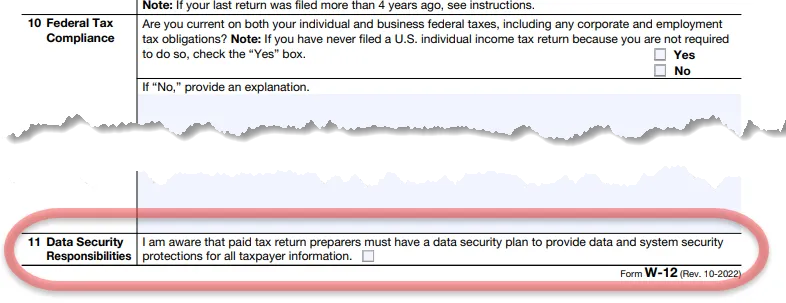

Form W-12 Requires You to Sign Off on Your Company Data Security

Are Ready?

We often hear small business owners say:

"Our computers have anti-virus, our files on saved on the Cloud (OneDrive, Google Drive, Dropbox), and my applications (QuickBooks, Ultra Tax, Microsoft Office 365) are hosted or not in my office. So we are good and safe."

Are you sure? Many businesses are just depending on anti-virus and the "Cloud" to protect them, guess what? Things have changed and many businesses have people working from home, using personal devices and unprotected wireless networks, this creates risk at a magnitude never previously imagined. The new risks are complex, and it's constantly evolving. The old way of managing risks, having a firewall, anti-virus, backup, and the cloud, does not cut it in the digital age of ransomware and cybercriminals. If you are seeing a bunch of pop-up messages or warning messages or unwanted emails constantly appearing in your mailbox, you already have a problem. Chances are high that you’ve already been compromised and are out of compliance.

We can help your business comply with the new FTC Safeguards Rule. There are 9 components required for compliance.

Copyright 2022 | eSudo Technology Solutions | TERMS & CONDITIONS